What To Expect

It’s not easy to keep calm and carry on as if everything is normal in the middle of a pandemic. We’re not wired for uncertainty. COVID-19 is creating uncertainty, and that is why markets are so volatile – moving up one day and crashing down the next.

The next time you look at your benefit statement, you might be disappointed by low, or even negative, investment returns. Your retirement savings may have decreased in value. Should you be worried?

Here’s Some Good News. You Don’t Need To Worry.

Time is a great healer, especially if you have a few years to retirement on your side. Relax, breathe deeply and do nothing. Ride out the volatility wave and give your retirement savings time to recover.

COVID-19 And Growth Assets

- Your retirement savings in Umbrella Funds are invested in investment portfolios.

- Investment portfolios consist of different asset classes that deliver different returns, which make your money grow.

- A big portion of your savings may be invested in the shares of companies, which are called equities.

- Equities are growth assets which deliver high, inflation-beating returns over the long term.

- This means that the long-term growth of your savings will be higher than inflation increases. It’s very important because we don’t want inflation to slowly reduce the value of our retirement savings over time.

- But equities are also volatile. Sometimes they deliver high investment returns and other times, like now, the returns are low and sometimes, even negative.

Lessons From The Past

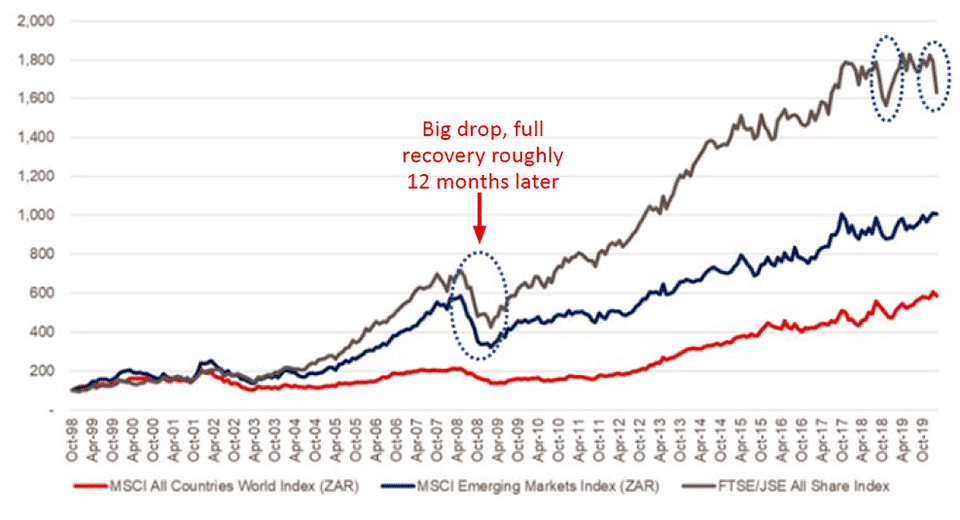

No one can predict the future, but here’s what happened in the past. This graph shows investment ups and downs since 1998. It shows a steady upward trend despite the ups and downs in between.

It’s very likely your portfolio will recover and deliver the inflation-beating returns you need in order to save enough for retirement.

- History shows that markets rise and fall all the time.

- We have experienced markets like this before, on many occasions.

- Despite the ups and downs, the overall trend is steady upward growth over the long term.

- When it comes to retirement savings, you’re saving for your future, not for next month.

- If you panic and change your investment now, you will lose real money.

Should You Switch To A Portfolio With Less Volatile Assets?

When shops drop their prices in a sale, our instinct is to buy the discounted items. But strangely enough, we don’t feel the same way about our investments. When market prices drop, we tend to panic and want to sell.

Why This Is Not A Good Idea

- If you switch portfolios when the market is down, you lock in your losses because you sell at a lower price.

- You also miss out on the opportunity to recover your losses and benefit from increasing prices when the market recovers.

Look at the graph above. Taking your money out of the market in October 2008 would have meant selling at a low price and missing out on the steady market recovery that happened in the years that followed.

Let’s Look At An Example

Your investment is : R100,000

Markets dropped by 25%: -R25,000

Your investment is now worth: R75,000

But you have only lost R25 000 on paper. You will only really lose R25 000 if you sell at the lower prices

| A PANIC RESPONSE | A SMART RESPONSE | |

| Switch your R75 000 to a conservative portfolio. Your losses are locked in. You have no chance to recover your R25 000. Financial loss! | Stay invested, you only lose R25 000 on paper. You can recover this loss when markets recover. Your investment will be worth R125 000 in a few years. Financial gain! |

What Should You Do?

Nothing. Sit out and wait for this storm to pass. Give your retirement savings time to recover.

What You Can Do Right Away

If you have some spare time during the lockdown period, why not get your financial affairs in order?

- Review your will.

- Make sure you have nominated the right beneficiaries.

- Create or rework your budget.

Take Control Of Your Financial Future!

Source: The impact of COVID-19 on your retirement savings by Momentum Corporate